Real estate investment teams are racing against time. From the moment an opportunity hits the market to final investment committee approval, every hour counts. Yet acquisitions teams spend the majority of their time on tasks that don't require their expertise: extracting data from offering memorandums, validating financial assumptions, comparing market comps, drafting investment memos, and assembling diligence packages.

The numbers are stark: Most real estate investment teams spend 50-60% of their time on documentation and data extraction rather than actual investment analysis and strategy. A typical $50M acquisition requires 80-120 hours of manual work just to compile, validate, and format information that already exists in source documents.

AI agents are fundamentally changing this equation. Unlike basic automation that simply moves data around, AI agents can read offering memorandums, validate financial models, research market claims, draft investment recommendations, and assemble comprehensive diligence packages—all while maintaining the rigor and auditability that institutional investors require.

Here are six AI agents that are already transforming how real estate investment teams evaluate and execute deals.

1. OM Summarizer Agent: Instant Investment Intelligence

The Problem

Reviewing private lending operating memorandums is tedious and time-consuming. Analysts spend 2-4 hours per OM manually extracting target returns, cash-on-cash yields, tax benefits, risk profiles, hold periods, and sponsor track records—all before even beginning actual analysis.

How the AI Agent Works

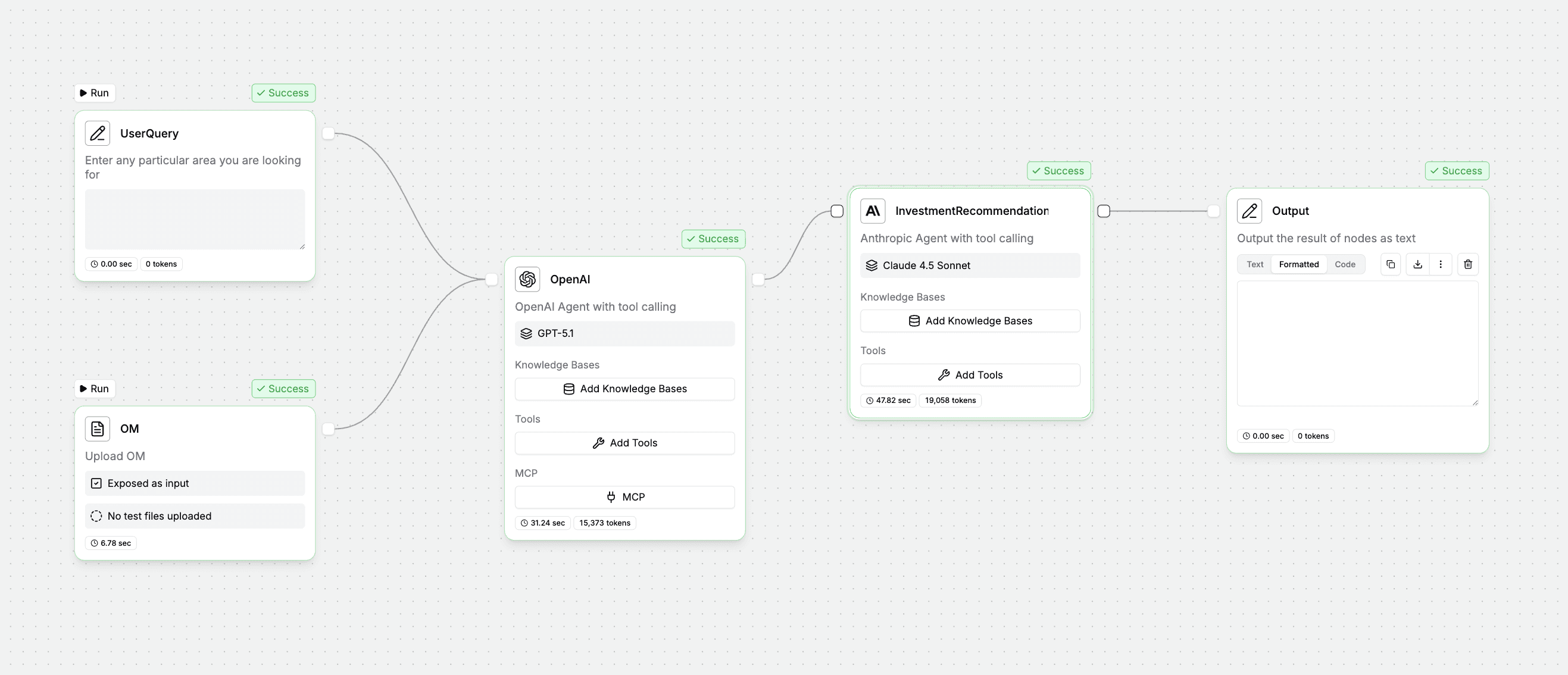

The OM Summarizer Agent transforms 100+ page OMs into actionable investment intelligence:

User uploads an Operating Memorandum PDF

AI extracts critical investment data points:

Target IRR and cash-on-cash returns

Investment structure and capital stack

Tax benefits and depreciation schedules

Risk profile and sensitivity analysis

Lock-in periods and liquidity terms

Sponsor background and track record

AI evaluates the opportunity against current market conditions:

Comparable deal terms in the market

Current interest rate environment

Sector-specific risk factors

Market timing considerations

Investment recommendation is generated with supporting rationale and citations

Results

Key metrics extracted in 5 minutes vs. 2-4 hours of manual review

AI-generated preliminary investment recommendation based on market conditions

Standardized OM analysis across entire deal pipeline

Investment committee materials ready for review in minutes

Who It's For

Real estate investment managers, acquisitions analysts, portfolio managers, and family office investment teams.

2. Acquisition Analysis Memo Drafter: Automated Investment Committee Materials

The Problem

Creating comprehensive investment memos requires manually synthesizing offering memorandums, underwriting models, market research, comp analyses, and risk assessments into a polished 10-20 page document. This process typically takes 8-12 hours per deal and represents a major bottleneck in the acquisitions pipeline.

How the AI Agent Works

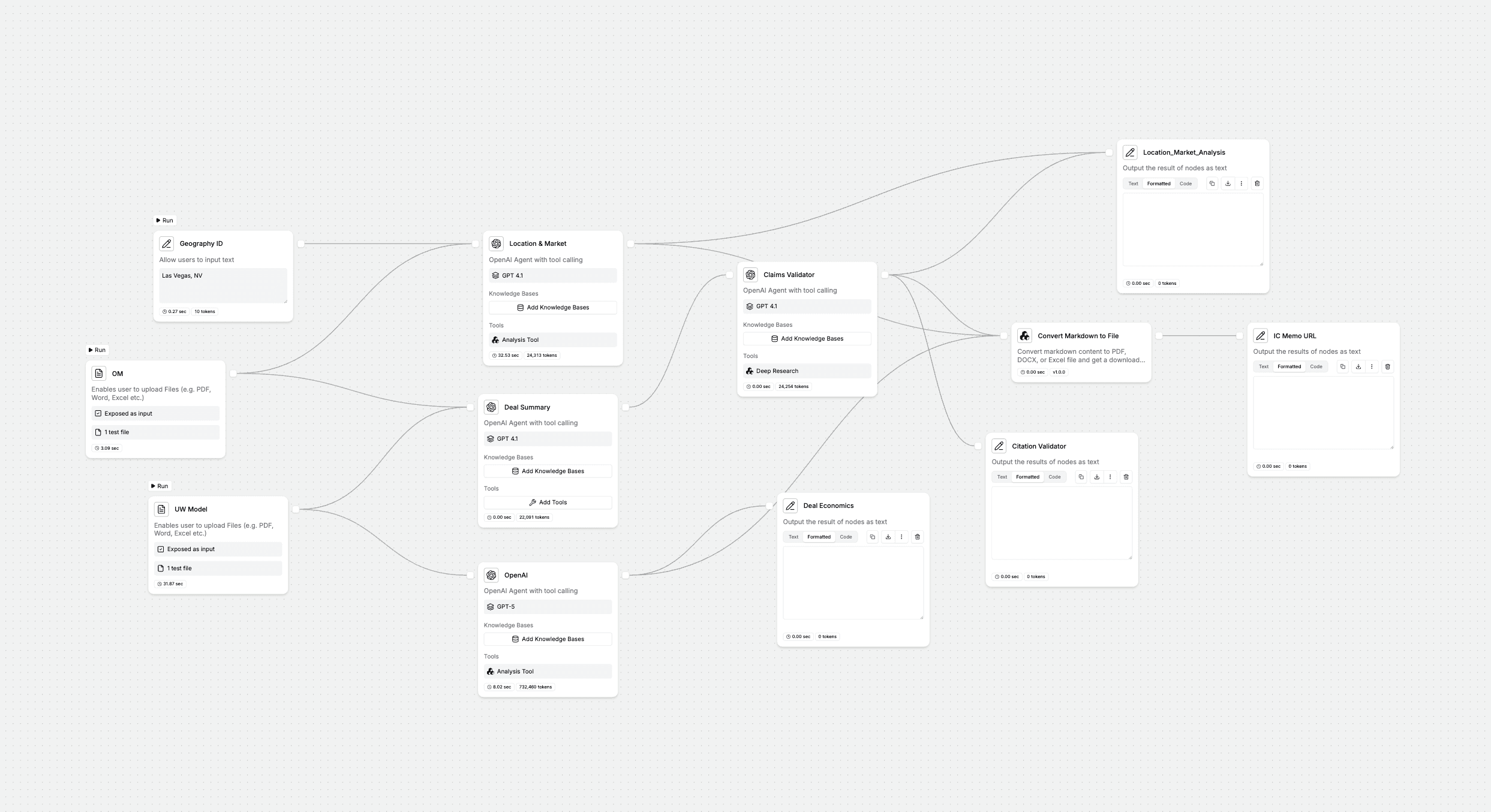

The Acquisition Analysis Memo Drafter automates the generation of professional investment committee memos:

User uploads offering memorandum (PDF) and underwriting model (Excel)

AI extracts and synthesizes multiple layers of information:

Property details and market context

Deal economics and return projections

Capital requirements and financing structure

Key assumptions and sensitivity analysis

Sponsor background and experience

AI researches and validates key claims from the OM:

Market growth projections

Comparable transaction data

Submarket dynamics and trends

Regulatory or zoning considerations

Comprehensive investment memo is generated with:

Executive summary and recommendation

Market overview and opportunity

Financial analysis and returns

Risk assessment and mitigants

Implementation timeline

Claims are tagged as validated, needs verification, or contradicts research

Results

Investment memos generated in 30 minutes vs. 8-12 hours

OM assertions automatically fact-checked against market data

Consistent memo structure across all deals

Red flags and inconsistencies surfaced automatically

Investment committee gets deeper analysis in less time

Who It's For

Acquisitions teams, investment analysts, portfolio managers, and asset management groups at institutional investors, REITs, and private equity firms.

3. OM Generator Agent: Professional Marketing Materials in Minutes

The Problem

Creating professional Operating Memorandums for capital raises or asset sales requires hours of manual work: compiling financial models, writing property descriptions, researching market context, formatting multi-section documents, and ensuring consistent branding. A quality OM typically requires 12-16 hours of analyst time.

How the AI Agent Works

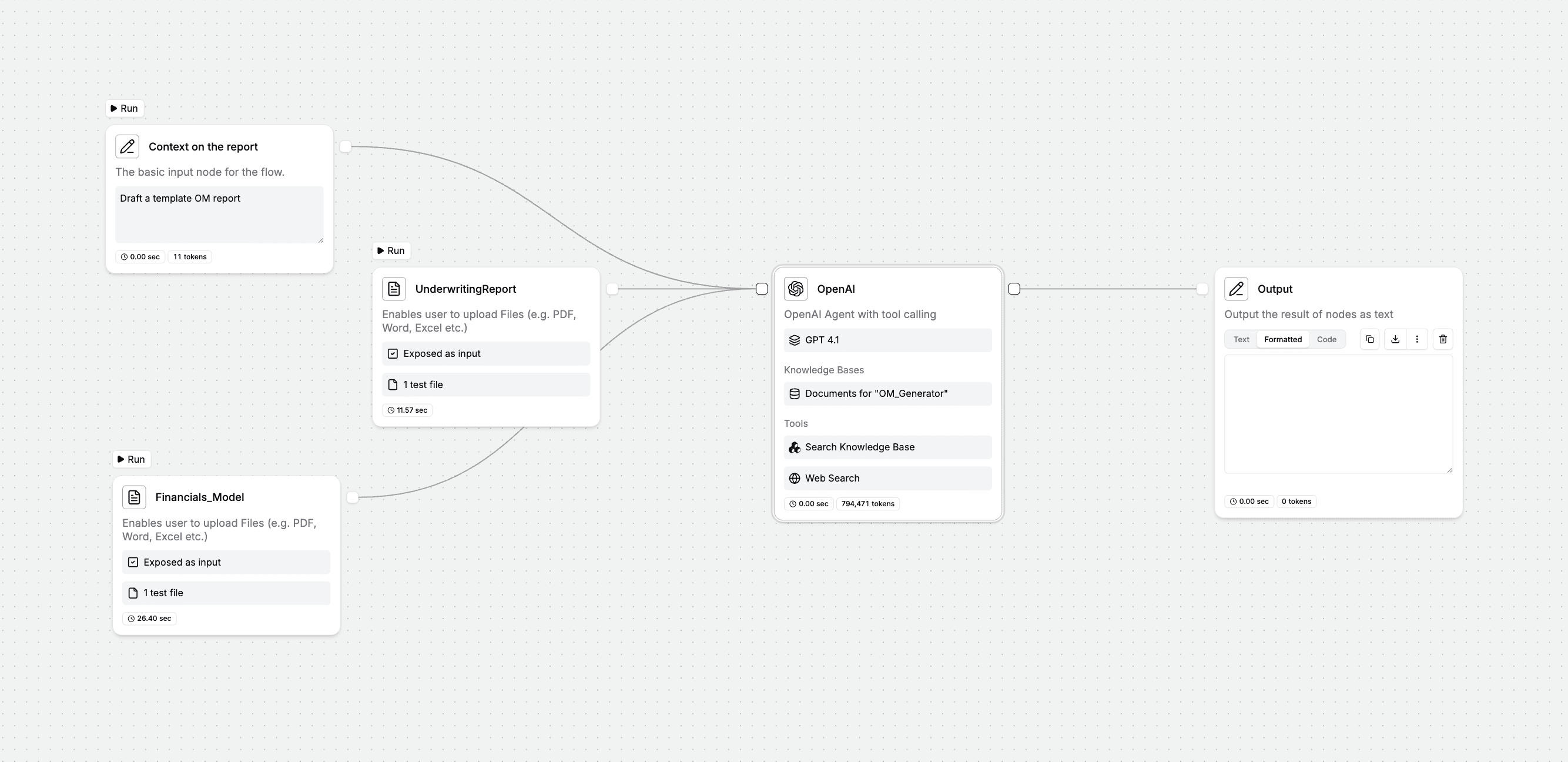

The OM Generator Agent automates comprehensive OM creation:

User provides underwriting report, financial model, and any additional context (property photos, market reports, tenant information)

AI processes and extracts key data from uploaded documents:

Property specifications and location details

Historical and projected financials

Market positioning and competitive advantages

Value-add opportunities or business plan

AI researches supporting market context:

Submarket demographics and growth trends

Comparable sales and leasing activity

Economic drivers and employment data

Complete OM is generated with multiple sections:

Executive summary and investment highlights

Property overview and specifications

Market analysis and opportunity

Financial performance and projections

Management team and track record

Transaction structure and terms

Professional formatting with consistent branding and layout

Results

Multi-section OMs generated in 20 minutes instead of 12-16 hours

Consistent structure and branding across all offerings

Market research automatically incorporated

Faster time-to-market for capital raises and dispositions

Analysts focus on strategy rather than document assembly

Who It's For

Investment sales teams, capital markets groups, asset managers preparing for refinancing or disposition, and sponsors raising equity for acquisitions.

4. Zoning & Entitlement Diligence Agent: Accelerated Development Feasibility

The Problem

Early-stage acquisitions of development sites or value-add opportunities stall for weeks while analysts dig through municipal zoning codes, entitlement processes, planning commission requirements, environmental restrictions, and historical approval timelines. This research typically requires 20-40 hours per site and often involves calling multiple city departments.

How the AI Agent Works

The Zoning & Entitlement Diligence Agent automates regulatory research:

Property address and development concept are provided

AI researches relevant regulatory documents:

Municipal zoning code and overlay districts

Comprehensive land use plans

Historic district requirements

Environmental restrictions (wetlands, floodplains, protected species)

Recent zoning amendments or variances

AI extracts critical constraints and opportunities:

Allowable uses by right vs. conditional use

Maximum density and height restrictions

Parking and setback requirements

Required entitlement processes and timelines

Historical approval rates for similar projects

Known community opposition or support factors

Risk assessment is generated:

Likelihood of entitlement approval

Estimated timeline and costs

Alternative use scenarios if primary plan fails

Political or community risk factors

Summary report delivered with citations to source documents

Results

Zoning and entitlement analysis completed in 2-3 hours vs. 20-40 hours

Allowable uses, density, and timeline constraints clearly summarized

Risk factors and alternative scenarios identified early

Investment teams make faster go/no-go decisions

Fewer costly surprises during entitlement process

Who It's For

Development teams, land acquisitions groups, value-add investors, and opportunistic funds evaluating sites with zoning or entitlement complexity.

5. Operating Partner Reporting Agent: Streamlined LP Communications

The Problem

Quarterly updates from operating partners and property managers arrive as fragmented PDFs, Excel models, narrative emails, and informal updates. Synthesizing these into polished LP reports requires manually extracting performance data, reconciling numbers across sources, and drafting executive summaries—typically 4-6 hours per property per quarter.

How the AI Agent Works

The Operating Partner Reporting Agent automates LP reporting:

Reporting packages are uploaded from multiple sources:

Property manager financial reports

Operating partner narrative updates

Capital expenditure tracking spreadsheets

Leasing activity reports

Photos and property condition updates

AI extracts key performance metrics:

Occupancy and leasing velocity

Revenue and expense performance vs. budget

NOI and cash flow generation

Capital improvements completed and planned

Lease expirations and renewal activity

AI reconciles numbers across different sources and flags discrepancies

AI drafts executive summary highlighting:

Performance vs. underwriting assumptions

Key accomplishments and challenges

Upcoming decisions or capital requirements

Value creation progress and timeline

LP-ready report is generated with consistent formatting and branding

Results

Quarterly LP reports generated in 30 minutes vs. 4-6 hours per property

Consistent reporting format across entire portfolio

Performance variance automatically flagged

Asset managers focus on strategy rather than data compilation

LP confidence increased through timely, professional communications

Who It's For

Asset managers, portfolio managers, investor relations teams, and fund administrators managing institutional capital.

The Competitive Advantage: Speed, Accuracy, and Capacity

The real estate investment teams implementing AI agents aren't just working faster—they're fundamentally changing what's possible.

The typical impact across the deal lifecycle:

Origination & Screening:

85% faster initial OM review and screening

3x more deals evaluated with same team size

Earlier identification of red flags and deal killers

Underwriting & Analysis:

80% reduction in investment memo drafting time

Deeper analysis through automated fact-checking and market validation

More time for scenario modeling and risk assessment

Due Diligence:

70% faster lease abstraction and document review

60% reduction in zoning and entitlement research time

Compressed diligence timelines without sacrificing quality

Asset Management:

75% faster quarterly reporting cycles

Standardized reporting across entire portfolio

Earlier identification of performance issues

The net result: Investment teams can evaluate more opportunities, conduct deeper analysis, execute faster, and manage larger portfolios—all with the same headcount.

Real-World Impact: Case Study

A mid-market multifamily investor implemented three AI agents (OM Summarizer, Acquisition Memo Drafter, and Lease Abstractor) across their acquisitions team:

Before AI Agents:

12-15 opportunities evaluated per quarter

8-10 day average time from OM receipt to investment committee

2-3 week due diligence timeline

5-person acquisitions team

After AI Agents (6 months):

35-40 opportunities evaluated per quarter

2-3 day average time from OM receipt to investment committee

1 week due diligence timeline

Same 5-person acquisitions team

The firm won 2 competitive deals they would have passed on previously due to timeline constraints, representing $85M in acquisitions that generated immediate value through faster execution.

Critical Success Factors: Getting AI Agents Right

While AI agents deliver dramatic efficiency gains, implementation requires attention to three critical areas:

1. Data Quality and Governance

AI agents are only as good as the documents and data they process. Successful implementations establish:

Standardized file naming conventions

Clear document version control

Defined data sources of truth for validation

Regular audit of AI outputs against human review

2. Human-in-the-Loop for High-Stakes Decisions

AI agents should accelerate analysis, not replace human judgment. Best practices include:

Human review of all investment recommendations

Confidence scoring that flags uncertain extractions

Clear escalation paths for complex scenarios

Audit trails showing AI reasoning and source citations

3. Integration with Existing Workflows

AI agents should fit seamlessly into current processes:

Integration with deal management platforms (Juniper Square, Kushner, etc.)

Export to familiar formats (Excel, Word, PowerPoint)

Compatibility with existing underwriting models

Alignment with investment committee requirements

Getting Started with AI Agents for Real Estate Investment

The barrier to entry for AI agents has dropped dramatically. You don't need a data science team, custom development, or massive budgets.

Platforms like StackAI provide:

No-code, drag-and-drop agent builder for investment workflows

Pre-built templates for OM analysis, memo drafting, and due diligence

Secure, on-premise or hybrid cloud deployment for sensitive deal information

Native integrations with Excel, SharePoint, Box, and major deal management platforms

Role-based access controls and complete audit trails for compliance

SOC 2, ISO 27001, HIPAA-ready infrastructure for institutional requirements

Most investment teams deploy their first AI agent in under two weeks and see measurable ROI within 30 days.

Next Steps: Transform Your Investment Operations

The real estate investment firms winning deals in 2026 aren't just faster—they're leveraging AI agents to evaluate more opportunities, conduct deeper analysis, and execute with conviction while competitors are still compiling data.

Ready to see AI agents in action?

Get a demo to explore how AI agents can transform your investment process

Download the white paper: AI Agents: 10+ Use Cases Transforming Real Estate